Manama, 16 Jumadil Awwal 1436/7 March 2015 (MINA) – The first training course on the convergence of Islamic capital and halal food and Muslim lifestyle sectors will be available in Bahrain from May 2015.

Being presented by the Bahrain Institute of Banking and Finance (BIBF) through a partnership with Dinar Standard, New York based growth strategy research and advisory firm, it has been developed as part of the Waqf Fund’s initiatives to enhance Islamic finance training in the region.

This was told during a press conference at the BIBF campus in Juffair, said a report in the Gulf Daily News and quoted by Halal Times and Mi’raj Islamic News Agency (MINA) as reporting.

Central Bank of Bahrain E.D. for banking supervision and Waqf Fund chairman Khalid Hamad said the kingdom was uniquely positioned to increase its standing as a regional financial hub to support the halal food and lifestyle sectors, provided their significant potential size.

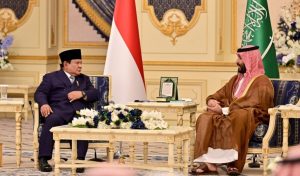

Also Read: Saudi Arabia Wins Bid to Host World Expo 2030

Rafi-Uddin Shikoh, Dinar Standard chief executive, who also addressed the press, said even as Islamic capital persisted to seek new growth opportunities, there was very limited engagement with the related halal economy sectors.

“There is a great need to develop Islamic finance professionals’ understanding of the opportunity and how to enhance it in terms of investment, working capital, trade financing, takaful and other necessities,’ he added.

“Strategic investments on the part of Islamic private equity firms in halal food and lifestyle related trades and businesses, trade financing, working capital financing, mergers and acquisitions, takaful, etc are just some of the ways Islamic finance can capitalize on these sectors.”

The halal food and Muslim lifestyle divisions are about to reach $2.47 trillion by 2018, based on the ‘State of the Global Islamic Economy 2014′ report, issued by Thomson Reuters with the help of Dinar Standard.

Also Read: 148 Products from Indonesia Promoted at Sarawat Superstore Jeddah

BIBF head of the centre for academics Ahmed Al Rayes said the managerial level course is tailored for Islamic finance and takaful executives and managers.

“It will give audience a summary of the halal market opportunity and focus on specific areas of financing/takaful needs and gaps by the key halal economy sectors of food, personal care, pharma, media and recreation, travel and fashion,” he added.(T/R05/R04)

Mi’raj Islamic News Agency (MINA)

Also Read: Packaging Industry Supports Halal Ecosystem

Mina Indonesia

Mina Indonesia Mina Arabic

Mina Arabic