Jakarta, MINA – Indonesia ranks second in the development of Islamic finance in 2020 based on the Sharia Financial Development Indicator (IFDI) index issued by Refinitv, the Islamic Corporation for the Development (ICD) and the Islamic Development Bank (IsDB).

“This will give optimism to Islamic banking and other sharia finance including the halal industry as well as for consumers,” said Executive Director of the National Committee for Sharia Economics and Finance (KNEKS), Ventje Rahardjo, during a virtual press conference in Jakarta on Tuesday.

Previously, IFDI Indonesia was in 10th position in 2018 and fourth in 2019 and this year Malaysia is in the top position. According to him, the neighboring country was in the first position because it made the development of Islamic economics and finance a part of national aspirations.

Meanwhile, Indonesia, he continued, in the last two years the spirit of economic development and Islamic finance has increased in ministries/institutions due to the government’s strong attention and support from all parties, including young people in formal institutions and from startup companies.

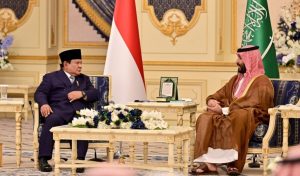

Also Read: Saudi Arabia Wins Bid to Host World Expo 2030

Meanwhile, KNEKS Sharia Ecosystem Infrastructure Director Sutan Emir Hidayat added that the increase in Indonesia’s ranking was influenced by a number of indicators, one of the most prominent being the improvement of Islamic financial education and research.

In addition, he continued, the awareness aspect also includes activities related to economic development and sharia finance to broad mass media coverage regarding the development of the Islamic financial economy in the country.

He noted that the fastest development in IFDI Indonesia was Islamic finance from US $ 86 billion in 2018 to US $ 99 billion in 2019.

Indonesia, he continued, was the first country to issue State Sharia Securities or green sukuk as an innovative source of financing for green infrastructure projects in Indonesia.

Also Read: 148 Products from Indonesia Promoted at Sarawat Superstore Jeddah

“The planned merger of state-owned Islamic banks, which is predicted to become a large bank, is predicted to grow Islamic finance more quickly,” he said. (T/RE1)

Mi’raj News Agency (MINA)

Also Read: Packaging Industry Supports Halal Ecosystem

Mina Indonesia

Mina Indonesia Mina Arabic

Mina Arabic