Dubai, 7 Muharram 1436/31 October 2014 (MINA) – Islamic banks may miss out on a huge opportunity, as a substantial number of Muslims perceive the banks as not having fully adopted sharia-compliant banking practices, according to a recent PricewaterhouseCoopers (PwC) survey.

The “What Customers Want” survey found that only 52 percent of Islamic-bank customers were confident their lenders were “truly Islamic banks and followed Islamic law”.

“The findings suggest that part of the reason customers may not be entirely convinced by Islamic banks may be due to the lenders’ tendency to mirror conventional banking products,” PwC’s partner and global Islamic financial services leader, Ashruff Jamall, said during the launch of the survey results on the sidelines of 10th World Islamic Economic Forum (WIEF) in Dubai on Tuesday, The Jakarta Post quoted by Mi’raj Islamic News Agency (MINA) as reporting.

The perception gap among bank customers, however, also offers an opportunity to the Islamic lenders, which are committed to developing deeper communication with and explaining their Islamic values to existing and potential customers.

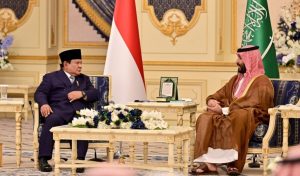

Also Read: Saudi Arabia Wins Bid to Host World Expo 2030

According to Jamall, huge opportunities exist for Islamic banks to grow and expand their market potential, particularly in countries with substantial Muslim populations.

“To achieve that potential, Islamic banks need to address the perception gap issue and also improve their service levels to be competitive with conventional banks,” he added.

Aside from the perception gap, the survey also found around 23 percent of Muslims between the ages of 18 and 24 used non-Islamic bank products. This percentage rose to 58 percent among Muslims aged 45 to 64.

“The challenge Islamic banks must address is to find a way to reverse the current trend among the Muslim population of using conventional banking as customers get older,” the report says.

Also Read: 148 Products from Indonesia Promoted at Sarawat Superstore Jeddah

Regarding banking services, the survey found more and more customers preferred using the Internet and mobile-banking platforms. Fifty-one percent of respondents said Internet banking was an important factor in determining their choice of bank.

This finding will, of course, encourage Islamic lenders to leapfrog the development of an extensive branch network by creating something more innovative and virtual.

The survey also found that around 20 percent of retail-banking customers were willing to switch to Islamic banks if they felt the level of service matched what they already enjoyed from conventional banks.

Separately, a research study issued Tuesday by the Citi Islamic Investment Bank (CIIB) suggested that the development of a wider range of short-term liquidity instruments would help Islamic financial institutions manage their liquidity.

Also Read: Packaging Industry Supports Halal Ecosystem

“Short-term sukuk are a useful addition to the problem of short-term Islamic bank liquidity,” the research study stated.

The development of short-term liquidity instruments is one of 12 foci that can be used to develop the Islamic finance sector. Others include improving corporate skills among Islamic banks, consolidating small Islamic banks on a larger scale, educating customers to boost demand and promoting Islamic microfinance.(T/P009/P3)

Mi’raj Islamic News Agency (MINA)

Also Read: Indonesia-Japan Agree on Energy Transition Cooperation

Mina Indonesia

Mina Indonesia Mina Arabic

Mina Arabic