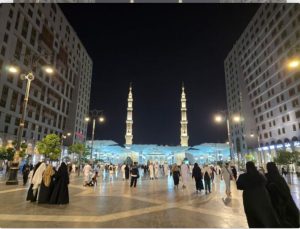

Islamic Banking

(Photo: en.mehrnews)" width="300" height="199" /> Islamic Banking (Photo: en.mehrnews)Ilorin, Nigeria 14 Rabi’ul Awwal 1435/5 January 2015 (MINA) – Experts in the field of Islamic banking are to converge on Ilorin, Kwara State from January 6th to 10th for a workshop to brainstorm on the development of Islamic Banking in Africa.

The workshop is being organized by the Islamic Research and Training Institute (IRTI), a research unit of the Islamic Development Bank Group in collaboration with University of Ilorin and Al-Hikmah University.

Addressing a press conference on the workshop, Chairman of the Local Organizing Committee (LOC), Dr. Abdulkadir Abikan explained that the workshop would bring together experts in the field from various countries in the world, dailytrust quoted by Mi’raj Islamic News Agency (MINA) as reporting, Monday.

He decried the underdevelopment of the Islamic financial system in Africa despite its strategic importance to the growth of the continent.

Also Read: Saudi Arabia Wins Bid to Host World Expo 2030

“Africa is a continent that needs this financial system more because of the way some other continents have taken advantage of this to take care of their infrastructural deficits and a lot of other developments that could be achieved from this industry”, Abikan said.

He emphasized that Africa has an alternative to take advantage of the system or remain backward as a continent, even as he lamented that in the whole of West Africa, there were only seven Islamic banking institutions.

Abikan, who is the acting Dean, Faculty of Law, Al-Hikmah University, attributed the underdevelopment of Islamic banking in Africa to the low level of development in the continent.

He noted that many people, especially in Nigeria, introduced religious sentiment into the banking model, noting that many countries with insignificant percentage of Muslims have embraced Islamic banking.

Also Read: 148 Products from Indonesia Promoted at Sarawat Superstore Jeddah

The scholar recalled that the Tax Law of United Kingdom was amended in 2004 by the former Prime Minister Gordon Brown in order to accommodate Islamic banking, saying, “The first Islamic Bank which is known as the Islamic Bank of Britain was launched in 2004 in UK.

“The best way for any reasonable government is to have Islamic banking. If we say because of religious volatility, we are not going to have Islamic banking, then we would be going backward”.

In a related development, a statement from IDB explained that experts in Islamic banking, regulation, and financial economics are expected to be at the workshop “to take stock of current academic research, policies, practice and development of Islamic banking in Africa.

“The workshop is also to explore current issues in Islamic banking and financial products, with a focus on the experiences of particular African countries in terms of regulation, supervision, systemic risk measures, stress testing, counterparty risk, opportunities and challenges”.

Also speaking, a member of the LOC, Dr. Lateef Oladimeji disclosed that 25 papers had been submitted so far with Malaysia dominating the list of entries.(T/P009/R03)

Also Read: Packaging Industry Supports Halal Ecosystem

Mi’raj Islamic News Agency (MINA)

Also Read: Indonesia-Japan Agree on Energy Transition Cooperation

Mina Indonesia

Mina Indonesia Mina Arabic

Mina Arabic