Developing Asia to fuel global growth but risks ahead, ADB said.

Manika, 10 Rajab 1438/07 April 2017 (MINA) – Developing Asian countries will drive the world economy in the next two years, the Asian Development Bank (ADB) said yesterday, but it warned of uncertainties from the United States and Europe, Bernama reported.

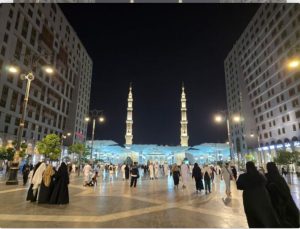

Also Read: Saudi Arabia Wins Bid to Host World Expo 2030

Its flagship Asian Development Outlook said India, Malaysia, Indonesia and Vietnam will be behind an expected 5.7 percent increase in Asia-Pacific gross domestic product (GDP), with China’s expansion seen moderating.

“Developing Asia continues to drive the global economy even as the region adjusts to a more consumption-driven economy in the People’s Republic of China,” Yasuyuki Sawada, ADB’s chief economist, said in a statement published Thursday.

With China’s economic growth seen slowing to 6.5 percent in 2017 and then 6.2 percent in 2018, regional expansion is tipped to come in slightly weaker than the 5.8 percent seen last year.

Chinese growth is at its weakest levels in a quarter of a century, hit by a drop in global demand for its goods but also as its leaders try to transform it from an economy driven by trade and state investment to one based on domestic demand.

Also Read: 148 Products from Indonesia Promoted at Sarawat Superstore Jeddah

“The recent upswing in the real estate sector and heavy industries will not last,” ADB analyst Jurgen Conrad said at a Beijing news conference yesterday.

“It doesn’t fit nicely in the rebalancing of the Chinese economy.”

Conrad added that a crucial challenge will be ensuring that investments are “truly productive” in a country where the state is responsible for a third of total investments.

While there is a solid foundation for growth, ADB Country Director for China Ben Bingham said: “The process of moving people from rural poverty to urban middle class is far from complete.”

Also Read: Packaging Industry Supports Halal Ecosystem

The Manila-based regional bank also warned that the uncertain outlook in the United States and Europe threw up risks.

As the US economy continues to strengthen, expectations are for the Federal Reserve to raise interest rates further this year — having already been lifted twice since December.

Higher Fed borrowing costs tend to hit emerging economies as it means investors withdraw their cash to seek better and safer returns in the US.

“Rising consumer and business confidence and a declining unemployment rate have fueled US growth, but uncertainty over future economic policies may test confidence,” the ADB said.

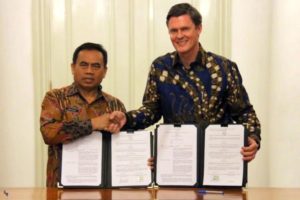

Also Read: Indonesia-Japan Agree on Energy Transition Cooperation

There are also lingering worries about US President Donald Trump’s warnings to revise global trade deals, fueling speculation he could spark a trade war.

‘Short-term shocks’

The ADB also said that while the eurozone was also strengthening, any potential growth was clouded by the uncertainty of Britain’s decision to leave the European Union.

Also Read: Dubai Expo 2020 Holds Special Event for Palestine

But Sawada added: “While uncertain policy changes in advanced economies do pose a risk to the outlook, we feel that most economies are well positioned to weather potential short-term shocks.”

Growth in South Asia is expected to hit 7 percent this year and 7.2 percent next year, with India rebounding from demonetization that temporarily hit the economy.

Indian Prime Minister Narendra Modi unleashed chaos in late 2016 with a shock move to withdraw high-denomination rupee notes from circulation to tackle widespread corruption and tax evasion. The ADB said the move hit cash-intensive economic activity, but that impact is likely to be short-lived.

“Government deregulation and reform of taxes on goods and services, among other areas, should improve confidence and thus business investment and growth prospects,” the report said.

Also Read: Indonesia Increases Excise on Tobacco Products by 2022

India’s growth is expected to hit 7.4 percent in 2017 and 7.6 percent in 2018. T/RS5/RS1)

Mi’raj Islamic News Agency (MINA)

Also Read: Indonesia to Become the Center of Sharia Economy in 2024

Mina Indonesia

Mina Indonesia Mina Arabic

Mina Arabic